When selecting irrespective of whether to rollover a retirement account, it is best to thoroughly contemplate your own problem and Choices. Facts supplied by Beagle is only for general purposes and isn't intended to replace any individualized suggestions for you to comply with a certain recommendation.

Beagle can teach you all of the hidden charges that happen to be robbing your retirement of Many dollars.

You can easily select an present IRA custodian of your respective decision or in the event you don’t have a person, Beagle is teaming up with top rated IRA providers to provide you with an marketplace-major very low fee robo-advisory Answer to deliver you an even better way to save for retirement.

Simplicity of use and Engineering: A person-friendly platform with on the net tools to track your investments, submit files, and control your account is very important.

Ahead of opening an SDIRA, it’s crucial that you weigh the possible benefits and drawbacks determined by your specific economical ambitions and chance tolerance.

Complexity and Responsibility: By having an SDIRA, you have got far more Handle around your investments, but You furthermore may bear more obligation.

Creating the most of tax-advantaged accounts lets you retain extra of The cash you devote and gain. According to no matter if you decide on a conventional self-directed IRA or perhaps a self-directed Roth IRA, you've the potential for tax-no cost or tax-deferred expansion, offered particular disorders are satisfied.

Constrained Liquidity: Lots of the alternative assets which might be held within an SDIRA, such as real estate, non-public equity, or visit here precious metals, is probably not quickly liquidated. This can be a difficulty if you'll want to accessibility funds promptly.

We describe the dissimilarities among two of the commonest varieties of everyday living insurance policies to help you choose what could possibly be best for your needs.

Due Diligence: It can be termed "self-directed" to get a cause. Having an SDIRA, you might be fully accountable for totally looking into and vetting investments.

Customer Help: Look for a provider that offers focused support, such as access to experienced specialists who can answer questions about compliance and IRS principles.

Yes, housing is one of our customers’ most popular investments, from time to time known as a real-estate IRA. Consumers have the option to take a position in almost everything from rental Houses, industrial property, undeveloped land, house loan notes and much more.

All investments have possibility, and no investment approach can ensure a revenue or secure from loss of capital.

At Beagle, we have been Weary of how difficult it had been to keep track of our aged 401(k) accounts. We under no circumstances understood exactly where all of them have been, should they ended up earning income or what expenses we ended up spending. That’s why we designed the easiest way to seek out your entire 401(k)s.

The tax positive aspects are what make SDIRAs eye-catching For most. An SDIRA could be each classic or Roth - the account sort you end up picking will rely mainly with your investment and tax strategy. Test together with your money advisor or tax advisor in the event you’re Doubtful and that is greatest for yourself.

Opening an SDIRA can provide you with access to investments normally unavailable via a bank or brokerage business. Below’s how over here to begin:

Including dollars straight to your account. Understand that contributions are subject matter to once-a-year IRA contribution restrictions established by the IRS.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Samantha Fox Then & Now!

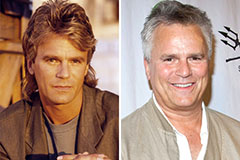

Samantha Fox Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!